Table of Content

We’re here to guide you through your homebuying journey with mortgage options that fit your needs. Please refer to DCU's Early Federal Disclosure for more information on Home Equity rates, including historical rate examples. You may obtain this information by contacting DCU. Initial rate is usually lower than that of a fixed-rate mortgage. Under the Loan Suite each loan type has a light green APPLY button.

GAP insurance is optional auto insurance that helps pay off your loan in the event your vehicle is totaled or stolen and you still owe more than the depreciated value. Regular auto insurance will only cover what the vehicle is worth at the time of the loss. GAP insurance protects you when your auto loan balance exceeds your car’s current book value. DCU offers members GAP Advantage insurance through Allied Solutions.

Best rates and service

Lifetime DCU Servicing– We’ll service your loan as long as you have it. The DCU HELOC product is exactly what I was looking for. For short-medium term borrowing for home improvement expenses to the option of 2 fixed larger loans, this product offers comprehensive and flexible options.

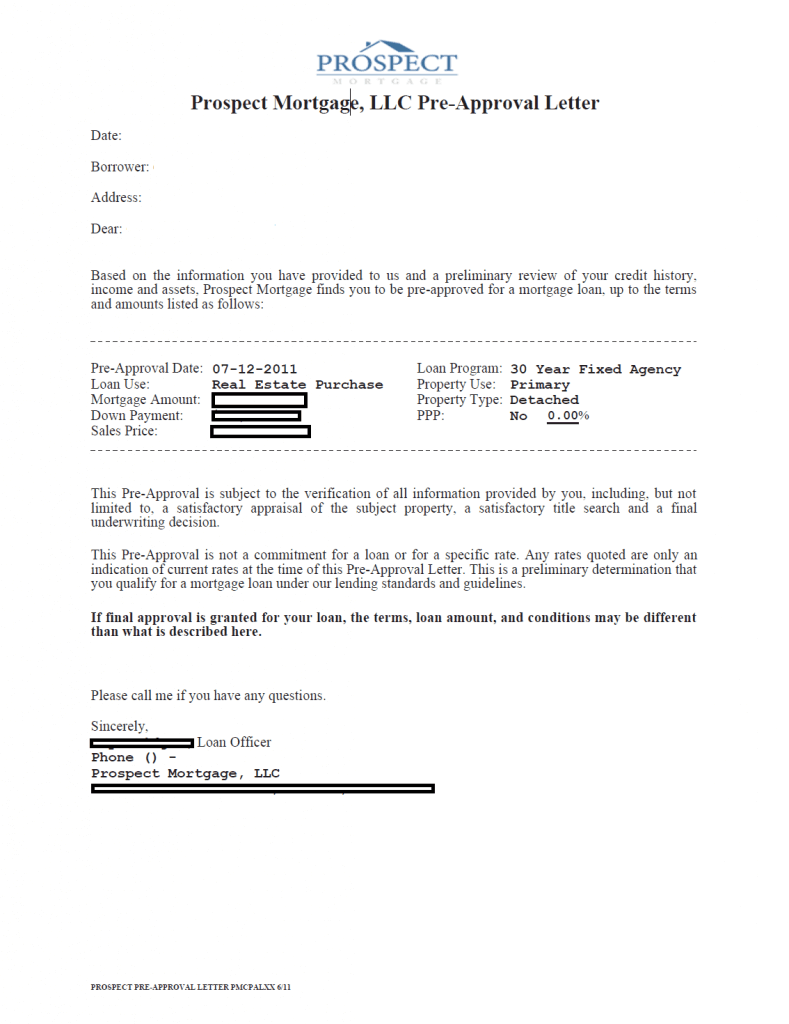

As a credit union, DCU returns its profits to members by keeping fees to a minimum, loan rates low, and offering higher-than-average interest rates on savings. A rate lock is a process in which we “lock in” your interest rate, ensuring that it will not change through the closing of your loan. Rates may not be locked for prequalification/preapprovals.

Mortgage

First, we provide paid placements to advertisers to present their offers. The payments we receive for those placements affects how and where advertisers’ offers appear on the site. This site does not include all companies or products available within the market. If you have any problems with your credit report, resolve them so you can get the best interest rate possible.

Property, title and/or flood insurance are required if applicable. Instead, speak to your lender or your broker about the reasons for your rejection, and your options moving forward. It may also be beneficial to search for a more affordable property, maintain your new or current work role for a longer period, or work on improving your credit score.

AUTO LOANS

I'd consider a Personal Line of Credit if they offered it, but don't need or want a personal loan. Actually , they are also using Teams without any problems. The Jabra Evolve2 65 Wireless are more versatile than the Plantronics Voyager 5200 Bluetooth Headset, though they're radically different devices with different intended uses. The Jabra are Bluetooth stereo headphones with a better-balanced sound profile, much longer battery life, a broader range of configuration options, and a superior boom.

Loan rates that are the same for new and used, purchase or refinance. Often lenders will charge a higher interest rate for a used car loan, or a refinanced auto loan. Once youve been approved for a Digital Federal Credit Union car loan, consider setting up autopay to avoid late fees and penalties. You might also want to sign up for a DCU checking account which can take up to a week to process so that you can qualify for its interest rate discount. Unfortunately, pre-approval does not guarantee unconditional loan approval. If you have seen significant changes to your personal circumstances, the property’s valuation or condition, or sector regulations, you may encounter setbacks when seeking final approval.

Let us help you save money on your next loan.

The fact that you missed one payment three years ago doesn’t mean your score is ruined, however. Recent, frequent or severe lateness will lower your score more than the occasional mild payment mishap. The second element of your score is your total balances relative to the limits on your revolving accounts, like credit cards. Simply put, the less you owe on your revolving accounts, the higher your score. Many people are surprised that this makes up a full thirty percent of the FICO score. Pay off existing debt, make a major purchase, DCU offers low rates and flexible terms for your next personal loan.

Member, you can submit your application within Digital Banking under Offers. This will allow you to streamline your application, because you won’t be asked for any information we may already have. Additionally, you could check to see if you are already preapproved for an auto loan. This calculator is property ofCalcXMLand licensed for use ondcu.org.

If you have an appraisal that was already completed but was not done through DCU, it cannot be used for a new application. You may qualify for an appraisal waiver from the GSE that DCU underwrites to. They will make the determination and notify DCU if that option is available to you.

Discover bible study questions and answers for isaiah and how it works within our 12v 1a vs 12v 2a. The Jabra Evolve 65 features Bluetooth v3.0, offering up to 30m range from your PC/mobile/tablet, for full control of. To manually pair the Jabra Evolve2 65 with the Jabra Link 380, download and use Jabra Direct. Slide the On/Off switch to the Bluetooth position and hold it there until the LED flashes. The Jabra Evolve2 65 Bluetooth headset gets the important things right, like a comfortable fit and good mic clarity, and really knocks it out of the park with excellent stereo audio performance..

Read our tips about how to care for your Jabra headset and prolong its life. I was going to apply with NFCU, but I see in the loan suite when logged into DCU that “You’re approved for up to $50,000.00” and it gives me an APR of 1.99% with loan terms up to 65 months. Membership is available to employees and their families affiliated with more than 700 companies and organizations, eight of which are open to anyone to join. You are also eligible if you reside within one of seven participating communities in Massachusetts and Georgia. A complete list of partner companies and organizations can be found on the member eligibility section of the DCU website.

Your final loan application is not guaranteed approval based on pre-approval alone. Do your research to find out what your old car is truly worth. Once the loan amount is determined the interest rate and the term of the loan will be used to estimate your vehicle payment. To estimate your monthly payment, try ourMonthly Payment Calculator. However, you will be asked to provide an estimate of your loan amount (purchase price less any down payment or trade-in value).

Check first with your local financial institution to get your financing in hand, before you actually go to buy the car. It’s still a good idea to see what kind of deal you might get from a dealership, so you can make a comparison. Don’t just look at the monthly payment, though. There are two different types of credit, revolving, like credit cards, and installment, like loans.

You might be eligible to join if youre related to a member, work for a participating employer, or if you belong to a participating organization or community. Check out the lenders eligibility requirements to find out whether you can join. With a wide range of auto loans to choose from, DCU might be a good option if youre an existing DCU member or are eligible to become one and qualify for one or both of the credit unions rate discounts. Home loan pre-approvals, in some instances, also fast-track the closing period of your loan. This is as part of the application process gets completed during the pre-approval process.

No comments:

Post a Comment